Because 75 of investment funds are concentrated towards bodies closely linked to trends in the interest market rate including Malaysian Government Securities loans or bonds and money market instruments low interest rates for the past few. Employees aged 60 and above.

What is the EPF interest rate for 202021 Malaysia.

. The EPF interest rate for FY 2018-2019 is 865. For the year 2021-2022 the current EPF interest rate was decided to be 81 and when it is finalized the monthly interest is calculated for the monthly balance and then for the year closing balance. Now including EPF Simpanan Shariah returnsUpdated.

The employee provident fund interest rate for 2022-2023 is 810the interest applicable per month When calculating interest is 81012 000675. Employer contributes 12 of the employees salary. EPF Dividend Rate.

The rate of interest is fixed at 865 per annum. We provide monthly updates on the best fixed deposit rates in Malaysia with tables showing the top 5 rates for the duration of 1 3 6 9 and 12 months. 5 hours agoThe financial services group however did not say why it planned to implement the split-tier method for calculating interest profit and dividend rates for its existing and new CASA and IA products.

There is an annual revision of PF deduction rates. The reason for the low returns of the provident fund is due to the poor performance of the capital markets as a whole. EPF historical returns data since inception in 1952 current investments overview dividend calculation and future performance estimates.

At Bursa Malaysia on Friday July 8 Maybanks share price closed up four sen or 047 at RM862 for a market value of about RM10318 billion. In Islam property acquired by means that. Sarawaks birth rate dropped by half in 2021 Premium.

For example if your monthly salary is RM3000 RM330 11 will be deducted from your. The EPF provides for compulsory retirement savings and contributions for all Malaysian citizens and permanent residents who are working in Malaysia. In addition to this you may also choose to increase your monthly contribution.

Total EPF contribution every month 3600 2350 5950. Sunway University economics. Your employer must also contribute an additional 12-13 of your salary to your account.

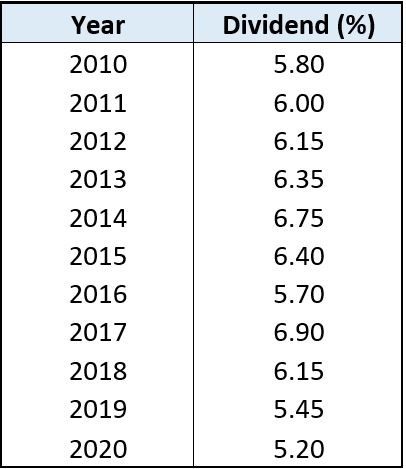

28 news release said. It is not compulsory for non-Malaysian citizens and non-permanent residents to contribute to the EPF but they may elect to do so. For 2021 the EPF dividend rate was 610 for conventional savings and 565 for shariah savings surpassing the previous years EPF dividend performance of 520 conventional and 490 shariahAccordingly the payout for 2021 will involve RM5045 billion conventional and RM627 billion shariah coming up to a total of RM5672 billion a new all.

Employee contributes 9 of their monthly salary. When calculating interest the interest applicable per month is 81012 0675. The interest rates on PF deposits have been reduced sharply in the last six year.

Islamic FD products continue to offer higher interest rates compared to conventional FD products. In 2018-19 it was increased to 865 per cent. It was lowered to 865 per cent in 2016-17 and further to 855 per cent in 2017-18.

When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings. The Employees Provident Fund is a part of Government of India National Savings Scheme NSS for all the employees working for organizations that fall under the specific guidelines provided by the EPFO. Latest Notification About the EPF Interest Rate.

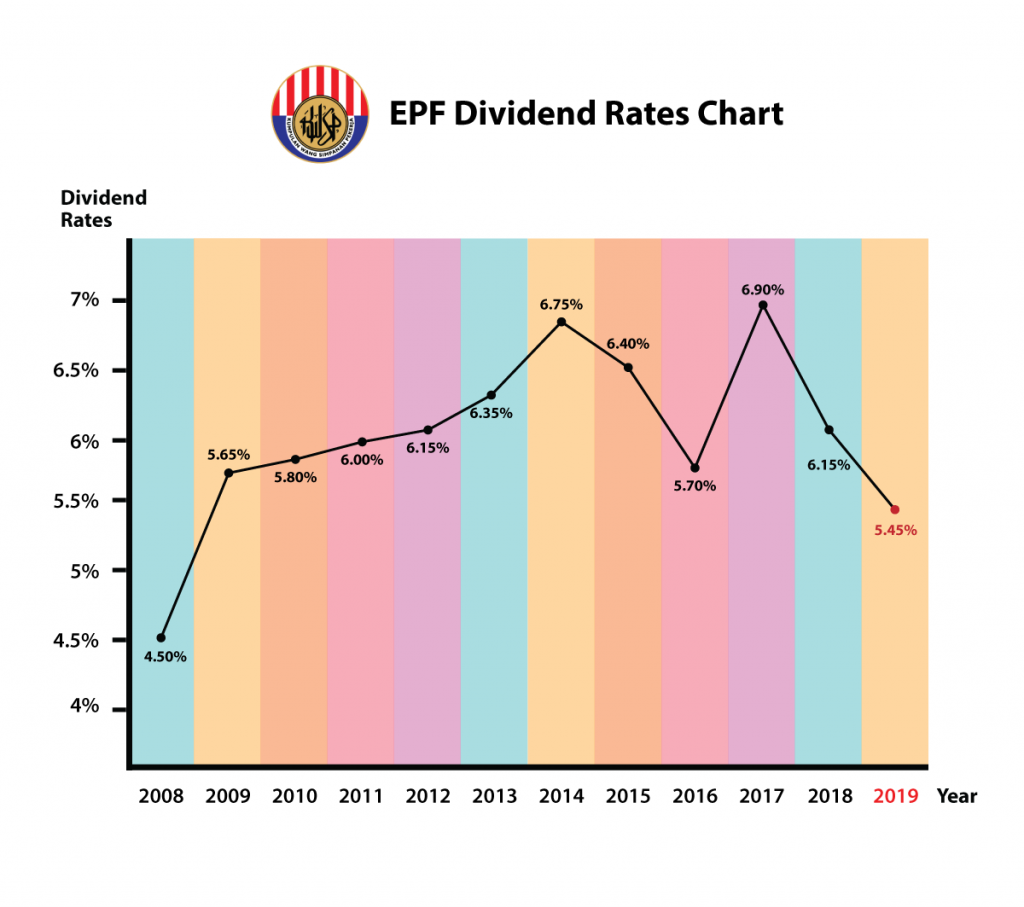

The vetted interest rate is applicable for. 9 of their monthly salary. Feb 27 2020EPF Historical Performance.

Total EPF Contribution for April 2350. Again to remind the provident fund interest will be calculated at the end of every month however the interest amount will. As mentioned earlier interest on EPF is calculated monthly.

In an interview with The Malaysian Reserve he predicted that the EPF dividend for 2021 will be about 52 percent to 55 percent for conventional savings and 49 percent to 52 percent for Shariah savings TMR. However either you or your employer or both may contribute at a rate exceeding the statutory rates. It is 035 less than the dividend rate in 2014 which was at 675 and that was the highest dividend since year 2000.

The EPF also attributes the declining interest market rate since 1996 to the interest market rate. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Employers and Employee make their specific contributions.

However in 2019-20 it was again lowered to 85 per cent. Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April. Lets use this latest EPF rate for our example.

For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table. EPF keep Malaysia employees salary percentage which familiar known as 11 some 7 with the new laws and regulations while employers contribute 13 of the employee salary. Over the weekend the Employees Provident Fund EPF finally announced the dividend rate for 2015 at 640 with a total payout of RM3824 billion.

So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. Employees share of the systems statutory contribution rate will be reduced to 9 of their monthly salaries from 11 for January through December 2021 a Nov. In 2015-16 the interest rate on PF deposits stood at 88 per cent.

DESPITE the headwinds last year the Employees Provident Fund EPF may declare a dividend rate ranging from 40 to 55 for 2020 according to a number of economists. The default EPF contribution rate is at 11 of your salary to your EPF account each month. Both of the amount of 11 from the employee and 13 from the employer add up together and store 70 into personal EPF account 1 while another 30 store into personal EPF.

Employers contribution towards EPF 367 of Rs 50000 Rs 1835. You better off stick with EPF which gives about 100k annual return which you want to. As resolved in the 87th Muzakarah Conference of the Fatwa Committee National Council of Islamic Religious Affairs Malaysia held on June 23-25 2009 as follows.

According to the EPF a dividend of 52 percent would be paid to conventional. The Malaysian EPF is a compulsory pension scheme for all Malaysians.

.jpeg)

Epf Elbowing Financial Repression Embracing Radical Transparency Rais Hussin And Margarita Peredaryenko Malay Mail

Why Epf Returns Are Lower The Star

Govt Ratifies 8 1 Epf Interest Rate For 2021 22 Deccan Herald

Epf Dividends For 2020 Could Be On Par With 2019 Or Just Slightly Less

Pin On Malaysian Business News

Epf Declares Dividend Of 6 10 For 2021 Above Pre Pandemic 2019 The Edge Markets

Malaysia Nominal And Real Rates Of Dividend On Epf Balances 1961 1998 Download Table

A Unit Trust Is A Form Of Collective Investment Constituted Under A Trust Deed Money Management Advice Investing Trust

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube In 2022 Investing Financial Literacy Fund

.jpeg)

Epf Elbowing Financial Repression Embracing Radical Transparency Rais Hussin And Margarita Peredaryenko Malay Mail

The State Of The Nation Epf 2021 Dividend Set To Top 2020 Absolute Payout To Hit New All Time High The Edge Markets

Mbsb 1171 Technical Analysis Analysis Chart

Pin By Uncle Lim On G Newspaper Ads Investing Learning Lettering

Latest Fd Epf Inflation Blr And Saving Interest Rates History Trend In Malaysia Saving Interest Rates Rate

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Govt Ratifies 8 1 Epf Interest Rate For 2021 22 Lowest In 4 Decades Business Standard News

Epf S 1h Performance Points To Higher 2021 Dividend The Edge Markets

Epf In A Low Interest Rate Environment

Suraya Suraya Eth On Twitter Because Now I Know How To Use A Financial Calculator I Can Say This On Average She Contributed Rm4528 Annually To Epf Of Which Rm2075 Is 11